Indices

Eurekahedge 50 Index: Frequently Asked Questions

EQUAL WEIGHTED HEDGE FUND INDICES

ASSET WEIGHTED HEDGE FUND INDICES

SPECIALIST ALTERNATIVE FUND INDICES

INVESTIBLE BENCHMARK INDICES

METHODOLOGIES

INDEX PRESS RELEASES

- Index Flash Update (June 2022)

- Index Flash Update (May 2022)

- Index Flash Update (April 2022)

- Eurekahedge launch four benchmark indices tracking volatility-based investment strategies

- Eurekahedge and MPI announce new benchmark index tracking the top 50 hedge funds

- Eurekahedge and ILS Advisers launch new USD hedge index

- Eurekahedge launches new insurance linked securities index

- Eurekahedge Asset Weighted Index goes live

- Eurekahedge Asset Weighted Index press release

- EU Benchmark Regulation

| Frequently Asked Questions |

|---|

|

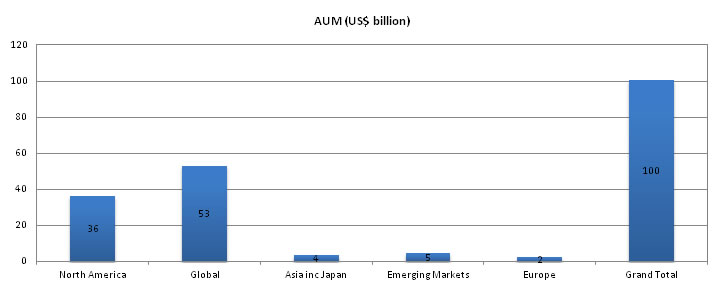

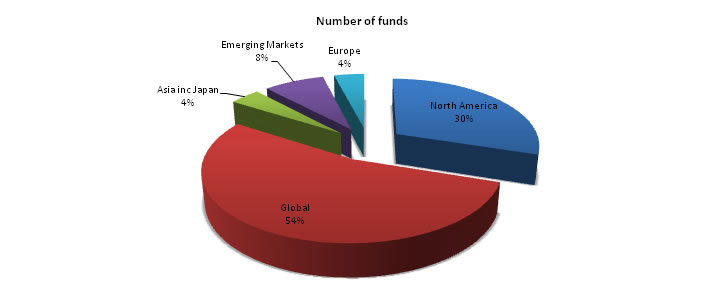

What is the total AUM of the index? At time of determination of the 2015 index constituents, the aggregate assets of the funds in the index were approximately US$100 billion. What is the breakdown of regional mandates by assets and numbers of funds? Breakdown by region of investment

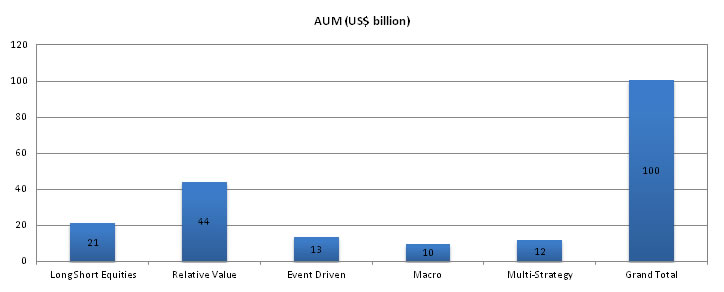

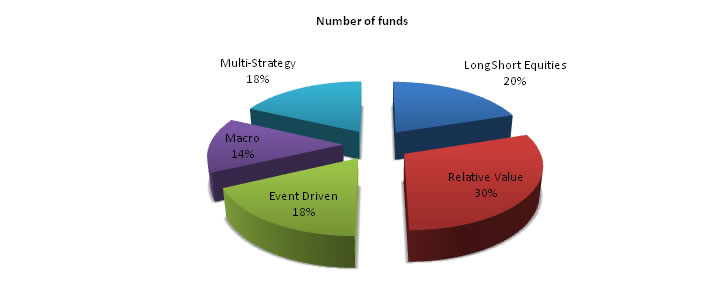

What is the breakdown of strategies by assets and numbers of funds? Breakdown by investment strategy

If there are 50 funds at the beginning of the year, and the index is rebalanced only once a year, what happens when a fund dies or stops reporting midway through the year? Once a constituent fund is determined to be dead or in liquidation mode, or if it has decided to stop reporting its pertinent data, the Index Committee shall determine the need for a replacement fund in the index, taking into account the adequacy of representation of strategies at the time, among other factors. The Committee may choose not to replace an outgoing fund if the number of remaining constituents is 47 and above. Why do you include funds that have a redemption frequency greater than 2 months? Based on our internal research, such funds seem to have an edge over other funds. Such terms allow the manager to focus more on achieving the investment objectives without being distracted by frequent flow requirements. If only 1 fund is included per company based on risk adjusted returns, what is the time period used to calculate the risk adjusted returns (e.g. Sharpe Ratio)? All statistics are computed using trailing 24 month data. What is the criteria and selection process to determine how a fund is selected for inclusion in the Eurekahedge 50, and is performance taken into consideration? This index starts with the 50 largest funds in the universe. For each management company with more than one fund, the index will select the fund with the better risk-adjusted performance and eliminate the other candidates. This process runs through several iterations bringing in the next largest funds until the index has 50 funds from 50 management companies. As a final step, we ensure that no strategy category is overly represented in the index. With this selection process, the index has 50 of the largest and ‘sharpest’ funds. It is not an index of the 50 largest funds, nor is it an index of 50 funds with the best risk-adjusted performance. Performance in itself is not an input into the selection process, although the index has exhibited consistent outperformance compared to the overall hedge fund universe in historical simulations. Why does size matter? Funds tend to become large as a result of their successful performance and the pedigree of their managers. Large funds have substantial resources and access to the best insights in the market, which could be helpful for navigating around turning points in market cycles. Large funds also tend to be better diversified which can be particularly helpful during stressful periods. These funds tend to have better downside protection, smaller drawdowns and shorter recovery periods compared with their smaller counterparts. Combined with risk-adjusted performance considerations, the Index has a pool of funds from a diversified set of hedge fund management companies, which have been both successful in generating returns and efficient in risk allocation. This, hypothetically, could serve as an institutional portfolio of funds. |

For more information on Eurekahedge indices, please contact us on +1 212 706 7020 (US office) or +65 6212 0925 (Singapore office), or email us at indices@eurekahedge.com.